what is a provisional tax code

They go towards the tax payable on income with no tax credits attached. Person who is told by the Commissioner that he or she is a provisional taxpayer.

Part 3 Income Tax And Provisional Tax

NZ Meaning and Definition.

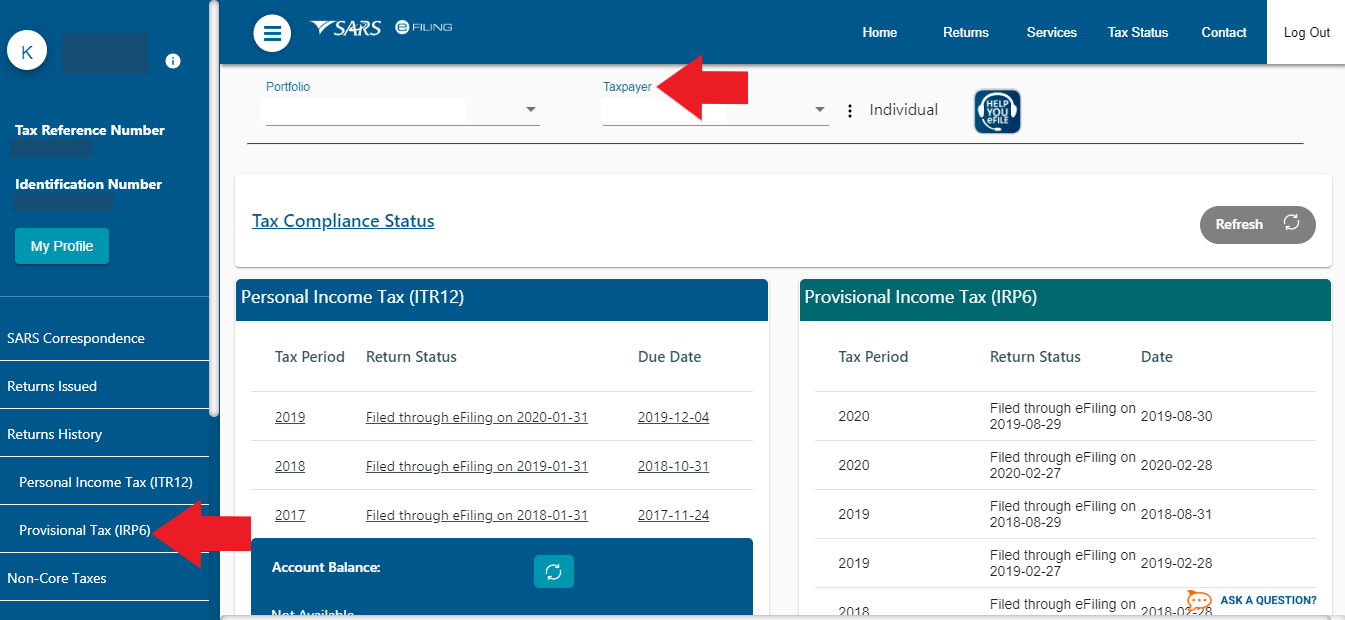

. Provisional taxpayers are required to submit two provisional tax returns during the tax year and make the necessary payment to SARS if a payment is due on the return. For administrative and accounting purposes it is important to include the correct tax item code when making payment. Use the check your Income Tax online service within your Personal Tax Account to find your tax code for the current year.

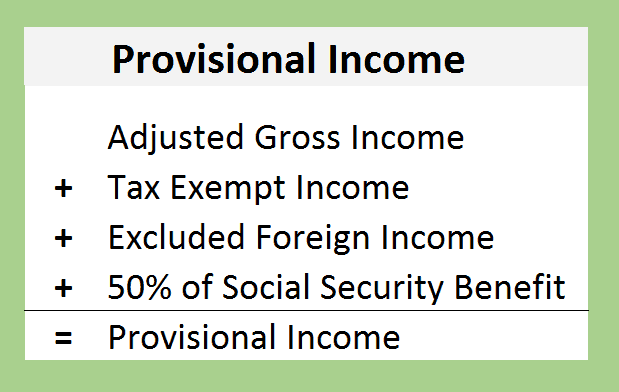

You pay it in instalments during the year instead of a lump sum at the end of the year. 2500 before the 2020 return. Provisional income is an amount used to determine if social security benefits are taxable.

Provisional and Terminal tax are both types of Income Tax. Income Tax Treatment of Social Security Benefits The income tax treatment of social security benefits is governed by section 86 of the Internal Revenue Code the Code. Amounts that you must pay under the provisional tax rules Amounts you choose to pay as voluntary payments to mitigate.

Now the calculation of the provision of the income tax will be as follows. 1 The base from 86 of the Internal Revenue Code IRC triggers the taxability of. Youll have to pay provisional tax if you had to pay more than 5000 tax at the end of the year from your last return.

Department of the Treasury. Now lets assume you receive 24000 in Social Security. If your provisional income falls between 25000 and 34000 for single or.

It requires the taxpayers to pay at least two amounts in advance during the year of assessment which are based on estimated taxable income. The first provisional tax return must be submitted within the first 6 months of the year and the second provisional tax return at the end of the year of assessment. Choosing the right account type.

Lets say your gross income is 20000 and you earned 2000 in municipal bond interest. A provisional taxpayer is defined as any. Provisional tax allows the tax liability to be spread over the relevant year of assessment.

Find your tax code. If at the end of the financial year it turns out that youve overpaid your tax - that is what you have paid in provisional tax through the year exceeds the tax owing at the end of the year the excess will be refunded to you unless you have other debts with Inland Revenue or you would. Excluded from being a provisional taxpayer as defined are any.

Provisional revenue is an IRS threshold above which social safety revenue is taxable. Provision for Income tax 21000. After clicking through the exit link below select the applicable year select 26.

Last operated tax code Provisional coding items Rounding up figures Take care and act promptly When is a secondary employment source record required Long tax codes S codes C codes. Add those amounts together to arrive at 22000. Heres a list of the codes to use for different tax or account types.

The base from 86 of the Internal Revenue Code IRC triggers the taxability of social safety advantages requiring its inclusion in gross revenue tax cost on extra quantities. Add this to 21000 to get a total of 28500. Prior to 1983 social security benefits were not subject to income tax.

In some cases if your provisional tax paid is less than your RIT Inland Revenue may charge you interest. Provisional income levels are calculated with gross income tax-free interest and half of the recipients Social. The MTN Mobile Money provides an option to select the tax type.

Provisional tax payments can be made up of. Thus from the above Statement of Calculation of Profit before taxes 70000 is the profit before tax of the company A ltd. 70000 30.

The base for provisional income is from 86 of the Internal Revenue Code. Provisional tax helps you manage your income tax. If your provisional income is less than 25000 for single or head-of-household returns or 32000 for joint returns then your Social Security benefits will not be taxed.

Provisional income calculations can get a bit complex though it is all laid out in 86 of the Internal Revenue Code IRC. Provisional income is a threshold set by the IRS and Social Security benefits are taxed if they exceed the set amount. Provisional tax breaks up the lump sum of income tax by paying in instalments throughout the year on provisional and terminal tax dates.

A third payment is optional after the end of the tax year but before the issuing of the assessment by SARS. Natural person who derives income other than remuneration or an allowance or advance. Ad For Simple Returns Only File Free Even When An Expert Does Your Taxes.

This code provides information on the tax item for which the payment is made and it must be provided regardless of the mode of payment being used. Several factors are assessed when calculating provisional income levels. Treasury regulations 26 CFR--commonly referred to as Federal tax regulations-- pick up where the Internal Revenue Code IRC leaves off by providing the official interpretation of the IRC by the US.

Its payable the following year after your tax return. When you make a payment to us youll need to use your IRD number as reference as well as a payee code showing which type of tax the payment is for. Determine your tax status from the overall total.

Approved public benefit organisations or recreational clubs. What is provisional tax. When you file your income tax return and calculate your tax for the year you deduct the provisional tax you paid earlier.

Treasury Tax Regulations. Individuals companies and trusts that paid more than 2500 tax at the end of the year from their last return are required to pay provisional tax payable the following year. If your provisional tax paid is more than your RIT youll get a refund and may receive interest on the difference.

It is -ought forward and credited against ordinary tax. Provisional taxes are tax payments made throughout an income year. Provisional tax breaks up the lump sum of income tax by paying in instalments throughout the year on provisional and terminal tax dates.

For the accounting year ending on December 31 st 2018. This entry about Provisional Tax has been published under the terms of the Creative Commons Attribution 30 CC BY 30 licence which permits unrestricted use and reproduction provided the author or authors of the Provisional Tax entry and the Lawi platform are in each case credited as the source of the Provisional Tax entry. Child support Kiwisaver and tax pooling payments.

Taxes On Social Security Social Security Intelligence

What Is Provisional Tax How And When Do I Pay It Taxtim Sa

What Account Do I Enter Income Tax Payments Under

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

What Is Provisional Tax How And When Do I Pay It Taxtim Sa

Italian Tax Code Codice Fiscale Studio Legale Metta

South African Provisional Tax Guide First Payment Youtube

The Impact Of The Tax Cuts And Jobs Act S Repatriation Tax On Financial Statements The Cpa Journal

Financial Components At Hcl Ppt Download

Taxes On Social Security Social Security Intelligence

Sales Tax Exemption For Farmers Carolina Farm Stewardship Association

Social Security Benefits You Can Check Estimated Social Security Benefit Calculator Include Monthly Re Social Security Benefits Adjusted Gross Income Coding

What Account Do I Enter Income Tax Payments Under

What Is Provisional Tax How And When Do I Pay It Taxtim Sa

L Agenzia Italian Health Insurance Card And Foreign Citizens Health Insurance Card For Foreigners Agenzia Delle Entrate